Why is sovereign debt bad?

High sovereign debt levels are associated with slower economic growth and rising default risk.

Like people and companies, sovereigns can struggle to repay their debt. This could be because they borrowed too much or in a way that was too risky—or because they were hit by an unexpected shock, such as a deep recession or a natural disaster. In these circ*mstances, the sovereign needs to restructure its debt.

A nation saddled with debt will have less to invest in its own future. Rising debt means fewer economic opportunities for Americans. Rising debt reduces business investment and slows economic growth. It also increases expectations of higher rates of inflation and erosion of confidence in the U.S. dollar.

Managing sovereign debt risk is crucial to maintain economic stability. High levels of debt can lead to reduced investor confidence, higher borrowing costs, and potential default.

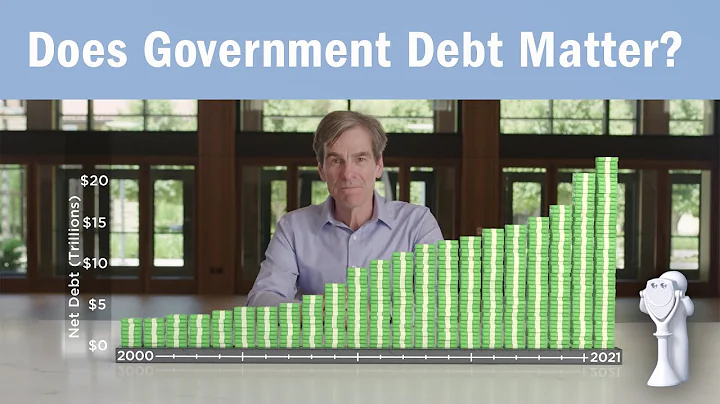

The U.S. national debt totals about $34 trillion. “That is a really hard number to really understand, right?” said Rachel Snyderman, the director of economic policy at the Bipartisan Policy Center in Washington, D.C. Debt can be a great thing, she said, helping to fund important programs and deal with crises.

When a state defaults on its sovereign debt, it disposes of its debt obligations owed to certain creditors. Disposing of the debts reduces the total debt owed by a state to its creditors, and subsequently, the principal and interest repayments.

There are two kinds of national debt: intragovernmental and public. Intragovernmental is debt held by the Federal Reserve and Social Security and other government agencies. Public debt is held by the public: individual investors, institutions, foreign governments.

1) Switzerland

Switzerland is a country that, in practically all economic and social metrics, is an example to follow. With a population of almost 9 million people, Switzerland has no natural resources of its own, no access to the sea, and virtually no public debt.

The $34 trillion gross federal debt includes debt held by the public as well as debt held by federal trust funds and other government accounts.

As we have discussed elsewhere, government debt reduces economic activity by crowding out private capital formation and by requiring future tax increases or spending cuts to accommodate future interest payments.

Why is sovereign debt good?

The national debt enables the federal government to pay for important programs and services even if it does not have funds immediately available, often due to a decrease in revenue.

For example, the U.S. government issues Treasury bills with maturities that range anywhere from within a few days to a maximum of 52 weeks (one year), Treasury notes with maturity dates of between two years and 10 years, and Treasury bonds whose maturity dates are 20 to 30 years in the future.

The public owes 74 percent of the current federal debt. Intragovernmental debt accounts for 26 percent or $5.9 trillion. The public includes foreign investors and foreign governments. These two groups account for 30 percent of the debt.

Given current projections for large primary deficits, demographic trends, and Federal Reserve policy focusing on controlling inflation, the United States should not be expected to grow out of its debt simply through rapid growth of GDP.

Around 70% of Japanese government bonds are purchased by the Bank of Japan, and much of the remainder is purchased by Japanese banks and trust funds, which largely insulates the prices and yields of such bonds from the effects of the global bond market and reduces their sensitivity to credit rating changes.

The world is looking at a debt crisis that will span the next 10 years, said economist Arthur Laffer Jr. Global debt hit a record of $307.4 trillion in the third quarter of 2023, with a substantial increase in both high-income countries and emerging markets.

The prospect of sovereign default is scary for investors, but many countries have never defaulted on their debts. Ecuador has defaulted 10 times in modern history, and Venezuela has defaulted 11 times.

What happens when a country defaults? For ordinary people, a default means higher food costs from inflation, as the government prints money to cover its costs. It means unemployment, as businesses and government agencies cut spending. And it means reductions in essential services such as health care and education.

Among other countries, Japan and China have continued to be the top owners of US debt during the last two decades. Since the dollar is a strong currency that is accepted globally, holding a substantial amount of US debt can be beneficial.

One of the main culprits is consistently overspending. When the federal government spends more than its budget, it creates a deficit. In the fiscal year of 2023, it spent about $381 billion more than it collected in revenues. To pay that deficit, the government borrows money.

What happens if China dumps US bonds?

If China (or any other nation that has a trade surplus with the U.S.) stops buying U.S. Treasuries or even starts dumping its U.S. forex reserves, its trade surplus would become a trade deficit—something which no export-oriented economy would want, as they would be worse off as a result.

An Explainer. Just about every country has debt: governments take loans to pay for new roads and hospitals, to keep economies ticking over when recessions hit or tax revenues fall. Sometimes they borrow from countries, other times banks, or maybe asset managers—companies like those investing your pension dollars.

As a result, totals from January 2023 are lower than reported. As of January 2023, the five countries owning the most US debt are Japan ($1.1 trillion), China ($859 billion), the United Kingdom ($668 billion), Belgium ($331 billion), and Luxembourg ($318 billion).

The financial position of the United States includes assets of at least $269 trillion (1576% of GDP) and debts of $145.8 trillion (852% of GDP) to produce a net worth of at least $123.8 trillion (723% of GDP).

China owes the United States $1.3 trillion, which is the most debt out of all the countries that are its debtors. Japan was the primary debt holder until 2008, but now comes in second place, with $1.2 trillion. Other countries with outstanding U.S. debt include Russia, India and South Korea.